Just over a year following the completion of the Trans Mountain expansion oil pipeline, the Crown corporation is actively pursuing two strategies to enhance oil export capabilities. This initiative comes as the pipeline is not yet operating at full capacity.

The $34 billion expansion project, which commenced transporting oil from Edmonton to Vancouver in May 2024, is currently running at approximately 80-85% capacity according to Trans Mountain officials.

Originally planned for assessment around 2028, the timeline for potential pipeline enhancements has been accelerated due to rising oil production in Alberta.

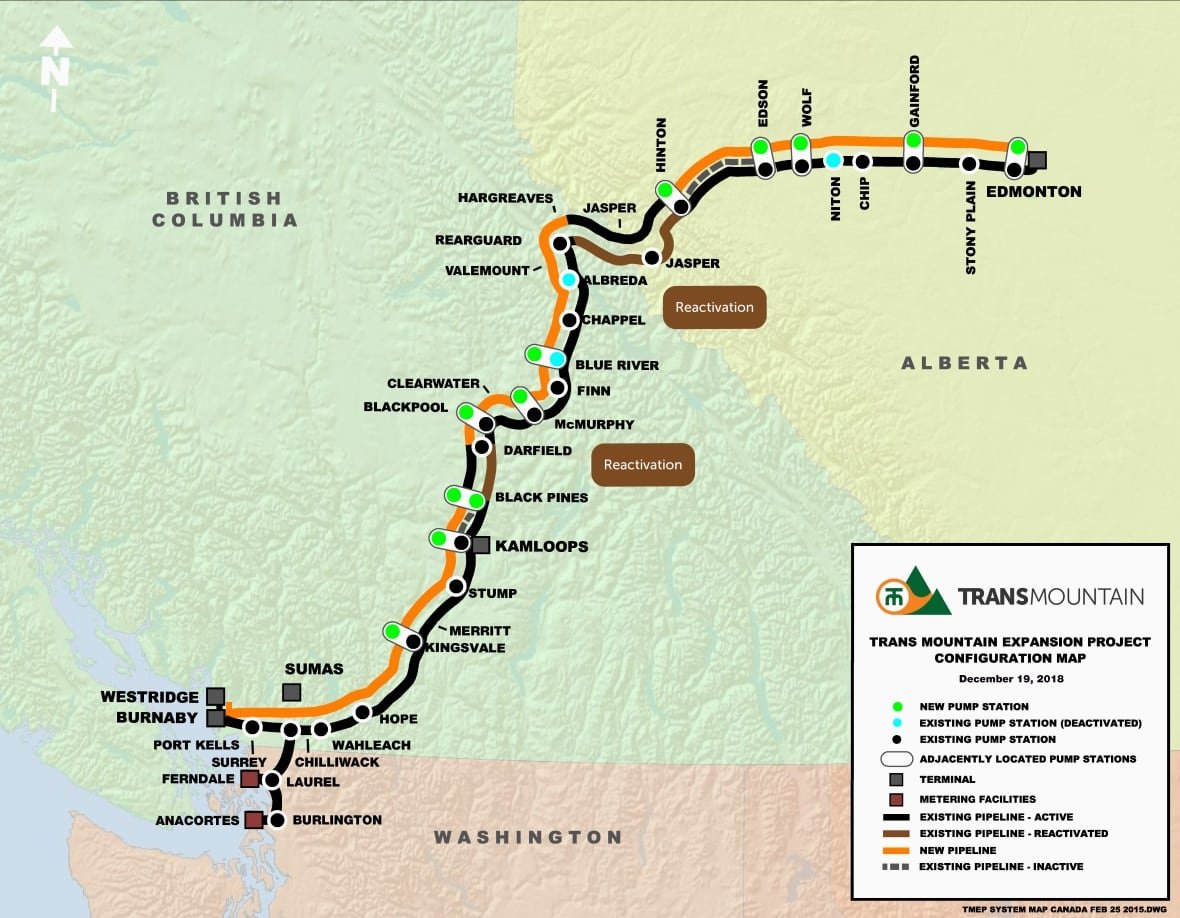

Although the physical dimensions of the pipeline will remain unchanged, the Crown corporation is investigating the use of drag reducing agents to amplify oil transportation volumes. Additionally, a separate project aims to bolster pumping stations to facilitate increased oil flow through the pipeline.

Trans Mountain’s Chief Financial Officer, Todd Stack, mentioned that the drag reducing agents, which are cost-effective chemicals, could boost capacity by 5-10%, equivalent to an extra 50,000-85,000 barrels of oil daily.

On the other hand, increasing pumping capacity is anticipated to be a more costly and time-consuming endeavor, with estimated costs ranging from $3 billion to $4 billion. Trans Mountain will spend the next year exploring this optimization project before making a final investment decision, followed by several years of construction.

Stack expressed confidence in funding the optimization project, noting that profits from current operations or potential debt could cover the costs. The approval of these projects by the federal government is a prerequisite for Trans Mountain’s advancement.

The expanded Trans Mountain pipeline has a total capacity of 890,000 barrels and is set to return $1.25 billion to Ottawa by year-end through interest, fees, and dividends.

Stack commended the exceptional performance of the Trans Mountain expansion, noting its smooth operation. However, the export terminal in Burnaby is not running at full capacity due to constraints related to the depth of the Burrard Inlet.

Efforts to dredge Burrard Inlet to accommodate fully loaded oil tankers are underway by the Vancouver Fraser Port Authority.

The surge in oilsands production in northern Alberta is driving oil production growth, expected to reach record highs this year with a projected 5% increase in 2025 compared to the previous year. Numerous companies, including Cenovus, Suncor, and others, are focusing on smaller-scale expansions and improvements rather than large-scale facilities.

RBN Energy warns of potential oil export limitations from Western Canada by mid-2027 without optimization projects by pipeline companies. Enbridge and South Bow are among the companies exploring options to export oil using existing infrastructure.

Trans Mountain and other pipeline companies’ proposed enhancements are expected to ensure sufficient oil export capacity from Western Canada for the next five years, according to Stack. He emphasized that the current capacity should suffice until 2030.

Forecasted oilsands production for this year stands at 3.5 million barrels per day, with an anticipated growth of 500,000 barrels per day by 2030 due to upcoming projects in the region.

The Trans Mountain expansion project has boosted western Canadian crude oil export capacity by 13% and export capacity to tidewater in Western Canada by 700%. This information was revealed in a report released by the Canada Energy Regulator.

Moreover, Canada’s crude-by-rail exports have declined significantly following the pipeline’s completion, as reported by the regulator. Data from Statistics Canada indicates a substantial